Introduction

The Ebury API helps you fund and manage your international business by making trading and payments easy to integrate into your applications. You choose how and where to deploy your application, and we provide the means to integrate foreign exchange and payment functionalities in them directly. The API is modular, with the following core areas of functionality:

- Quotes: Get live rates, either estimated or a short-lived quote that you can use to book a trade;

- Trades: Use a quote to execute a trade;

- Payments: Use a trade to fund payments;

- Multi Payments: Wraps trades, beneficiary management and payments into a "bulk" operation, allowing payments initiation across a number of currencies;

- Account Management: Profile updates, beneficiary management, etc.

In terms of style, the API is a "pragmatic" REST + JSON API with a design approach aimed at simplicity and ease of use. A few notes:

- URIs do not descend more that one i.e. /quotes, /trades, etc.;

- We use links where it makes sense to convey information to our API consumers but we are not religious about full-on HATEOAS/code-on-demand style. If links help we use them;

- We will version our API on major versions only, with the version number defined in the hostname , e.g. https://api-v1.ebury.io/trades;

- We'll be looking to add support for Webhooks once our first production release is GA.

Getting Started

The Ebury API has been designed for ease of use, but there are a number of things that need to happen or you need to know before you can start developing against it.

Onboarding

In order to use the API your company needs to be one of the following:

- To be an existing Ebury customer with access to Ebury Online;

- To be on-boarded as an Ebury customer with access to Ebury Online: Currently this is an out-of-band process that needs to be completed by the Ebury sales team.

Credentials

With an active Ebury Online account you need a few details to call the API:

- A client secret that is used in the Authentication workflow described below;

- An access token which you will get by implementing the Authentication workflow;

- A client account identifier that links a user to a given account and needs to be passed to the Authentication workflow;

- You'll need to supply a redirect URL, which will be used during the Authentication workflow.

Environments

The following is a list of environments available when developing against or using our API:

Environment Endpoints

| URL | Purpose |

|---|---|

https://sandbox.ebury.io |

Sandbox API endpoint |

https://auth-sandbox.ebury.io |

Sandbox authentication endpoint |

https://api.ebury.io |

Production API endpoint |

https://auth.ebury.io |

Production authentication endpoint |

https://trustedsandbox.ebury.io |

mTLS Sandbox (both authentication and API) |

https://trusted.ebury.io |

mTLS Production (both authentication and API) |

API Description

Whilst each subject area is documented below they are also supported by an individual Swagger specification document. Please use the links below to download for your desired environment:

| Environment | JSON | YAML |

|---|---|---|

Sandbox |

https://sandbox.ebury.io/openapi.json | https://sandbox.ebury.io/openapi.yaml |

Production |

https://api.ebury.io/openapi.json | https://api.ebury.io/openapi.yaml |

Rate limiting

Rate limiting of the Ebury API is primarily on a per-client basis. If you receive a response with a status code of 429 Too Many Requests, it means that you have been rate limited for sending too many requests, and should wait before sending further requests.

Error Handling

The Ebury API tries to honour HTTP return codes relevant to the error that is being conveyed. However, 4xx HTTP return codes are also used as a "blanket" with more information to be found in the response body of the error message e.g., a 409 will indicate an issue with the data sent that can be rectified: you should consult this message to help you take corrective action.

Idempotency

The Ebury API is not exposing idempotent operations by default.

The POST requests can however include a header X-Idempotency-Id, to be used as a lock to gain idempotency features.

After every POST request, the response header X-Idempotency-Status is returned with the result of the idempotency logic.

This is an opt-in feature. If the header X-Idempotency-Id is not present, no extra logic is considered.

The first time the API sees a X-Idempotency-Id, it returns accepted and locks the value for 15 days.

The following times the same value is used within the first 15 days: the API will return duplicated, with status 409, and will not process the request.

We suggest using a random UUID as X-Idempotency-Id.

Summary for situations.

| Request method | X-Idempotency-Id |

Response status | X-Idempotency-Status |

Meaning |

|---|---|---|---|---|

No POST |

Not checked | As usual | Not present | No extra logic |

POST |

Not present | As usual | missing |

No extra logic |

POST |

Present, first time seen | As usual | accepted |

Lock acquired for 1 day |

POST |

Present, already seen in last day | 409 | duplicated |

Lock was already acquired, this request was already accepted |

POST |

Present, but the system cannot check it | 503 | unavailable |

The intention was acknowledged, but the service cannot check for the idempotency |

HTTP Response Codes

| Response code | Meaning |

|---|---|

200 OK |

Request completed successfully. See individual endpoints for details of response content. |

201 Created |

Request completed successfully, and a resource was created. See individual endpoints for details of response content. |

202 Accepted |

Request completed successfully, but not completely processed. See individual endpoints for details of response content. |

400 Bad Request |

The request could not be processed due to some error e.g., formatting, parameter or schema validation. See error message for details of response content. |

401 Unauthorized |

Access denied due to authentication failure |

403 Forbidden |

Could not complete action due to data constraints. See error message for details of response content. |

404 Not Found |

The requested resource could not be found. See individual endpoints for details of how to identify resources. |

409 Conflict |

Request could not be completed. See error message for details of response content. |

429 Too Many Requests |

You have exceeded the rate limit for IP or server. See rate limiting for details. |

502 Bad Gateway |

Internal error. See error message for details of response content. |

503 Service Unavailable |

Internal error. See error message for details of response content. |

504 Gateway Timeout |

Internal timeout. See error message for details of response content. |

422 Unprocessable Entity |

The request could not be completed due to invalid or incorrect data. See error message for details of response content. |

Error Message

{

"code": "string",

"message": "string",

"details": "string"

}

Error messages are presented as JSON objects.

Error Message Fields

| Field | Description |

|---|---|

code |

A short code for the error |

message |

The error message |

details |

Error details |

Verification of Payee

Due to a regulation regarding Corporate Payments, the Ebury API runs some Verification of Payee validations on beneficiaries when payment requests are done.

Verification of Payee validation checks if the Beneficiary data stored in Ebury (if the request contains a Beneficiary ID) or provided (if the request contains Beneficiary Name, IBAN and Swift Code) matches the actual Bank details. A full-match confirms that everything is correct, a partial-match lets us know that the data is close but not exactly the same (name varies slightly), and no-match warns us that the data is different, which could cause a scam to take place if we go forward with the payment. We also have other error statuses for cases like being unable to find the beneficiary ID provided in our systems, or the system to run the validations is not available at the moment.

When a Single Payment, Multipayment or Mass-Payment request runs the VoP (Verification of Payee) check, two things can happen:

* The VoP result is a full-match (for all payments involved), and the payment goes through directly.

* At least one of the payments did not return a full-match, and the payment does not go through. The request gets a response with a specific error message indicating this VoP result.

As part of the VoP response, an authorization_id is provided. That authorization_id can be used as queryparam on the payment requests to confirm that the customer wants to go with the payment even though the VoP check was not full-match. The request itself needs to contain the same data as the previous attempt, only the new vop_authorization_id queryparam needs to be added, holding the value of the authorization_id received in the previous error response.

If the vop_authorization_id queryparam is provided in the Single Payment, Multipayment or Mass-Payment request, the system will check that the value ID matches the one in our database (including the whole request payload received alongside it) and, if it matches, the payment goes through. Otherwise, it returns a specific error explaining that the provided vop_authorization_id is not correct.

We have two flags to activate Verification of Payee for customers once they are fully integrated with the new implementation.

vop_opted_outskips Multipayment and Mass-payment (bulk payment) Verification of Payee checks. This is part of the Verification of Payee regulation: any customer that wants to Opt Out of VoP for bulk payments can do so by providing an official signed letter requesting to be opted out of the feature. Apart from this, all customers will be initially opted out, until a grace period, for them to have time to integrate with the new API flow for VoP. After that, any customers that have not provided theOpt Outletter will be marked asfalseforvop_opted_out. If a customer Opts Out of VoP, no changes will be needed regarding endpoint implementation.vop_skip_single_paymentsskip Single Payment (/payments) Verification of Payee checks. This is just a flag we added to give customers some time to integrate with the new API flow for VoP. Initially, all customers will have the flag active. Single Payments cannot be opted out of Verification of Payee according to the regulation, so after the grace period, all API customers will be marked asfalseforvop_skip_single_payments.

Regardless of a customer's values for these flags, the /vop endpoint will always be available once the feature is launched by October 9, 2025, and therefore will be able to run Verification of Payee checks.

VoP Error Codes

| Code | Description |

|---|---|

VOP_PARTIAL_MATCH |

VoP check returned a partial-match |

VOP_NO_MATCH |

VoP check returned a no-match |

VOP_INTERNAL_ERROR |

VoP check could not be done due to an internal error |

VOP_VERIFICATION_FAILED |

Provided authorization_id is invalid for the payment data |

VoP Check Error Message

The VoP Check not full-match error message will hold the following information:

| Field | Description |

|---|---|

code |

The VoP error code |

message |

Explains the reason why the system returned a VoP error |

details |

The VoP check details |

{

"code": "string",

"details": {

"authorization_id": "string",

"results": [

{

"message": "string",

"name": "string",

"scheme_response_codes": [

"string"

],

"status": "string"

}

],

"status": "string"

},

"message": "string"

}

VoP Check Details

| Field | Description |

|---|---|

authorization_id |

The ID that can be used as vop_authorization_id queryparam to go through with the payments that didn't return a successful full-match VoP result. |

results |

A list of vop results, one for each Beneficiary involved in the verification check |

status |

Highest priority status received from VoP checks |

VoP Result

| Field | Description |

|---|---|

message |

General information relating the VoP result |

name |

If partial-match, the actual Beneficiary name in the Bank data. |

status |

The VoP result for the Beneficiary. One of FULL_MATCH, PARTIAL_MATCH, NO_MATCH, UNABLE_TO_MATCH or an error. |

scheme_response_codes |

List of response scheme codes. Field to have a reference of the VoP error origin. |

Authentication

The Ebury authentication scheme is based on OpenID Connect 1.0, which builds on OAuth 2.0 to make it easier to verify the identity of end users. We've chosen OpenID Connect as we believe it offers our consumers a good mix of security and flexibility and implemented that Authorization Code flow for OpenID Connect: The steps required to complete this flow are detailed in the following sections.

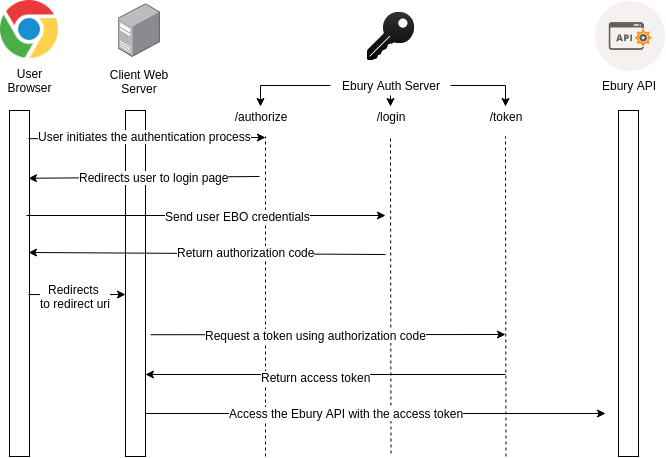

The diagram below shows an overview of the process when Second Factor Authentication (2FA) is disabled:

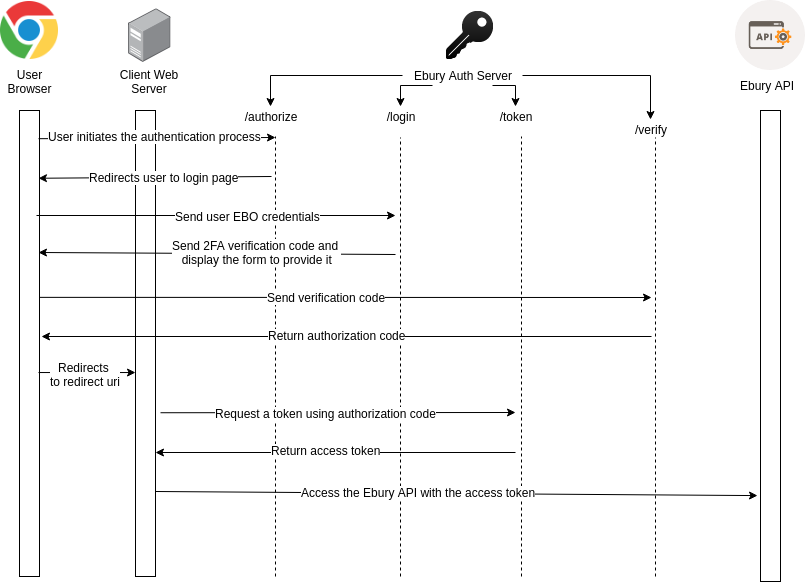

When 2FA in enabled the process is slightly different as can be seen on the following diagram:

Acquire an access token

Acquiring an access token is a three-step process:

- Redirect the user to Ebury to authorise your app

- The user authenticates with Ebury

- If 2FA is enabled, the user provides the verification code on the 2FA screen

- Ebury redirects the user back to your app with an authorization code

- Exchange the authorization code for an access token

Redirect the user to Ebury

"https://auth.ebury.io/authenticate?

scope=openid&

response_type=code&

client_id=$client_id&

state=$state&

redirect_uri=$redirect_uri"

To start the authentication process a request needs to be made in a browser to our authorization server to identify the application attempting to access the user's profile. This may be implemented in a mobile or web application but the access tokens can be used for server-based applications as well.

Query Parameters

| Parameter | Description |

|---|---|

client_idRequired |

Your client identifier |

scopeRequired |

Must be openid; no other values are supported |

response_typeRequired |

Must be code |

stateRequired |

A random, per request value used to maintain state between request and callbacks and protect against cross-site request forgery attacks |

redirect_uriRequired |

The redirect URL that is registered for your application, this must match the value we hold |

User Authentication

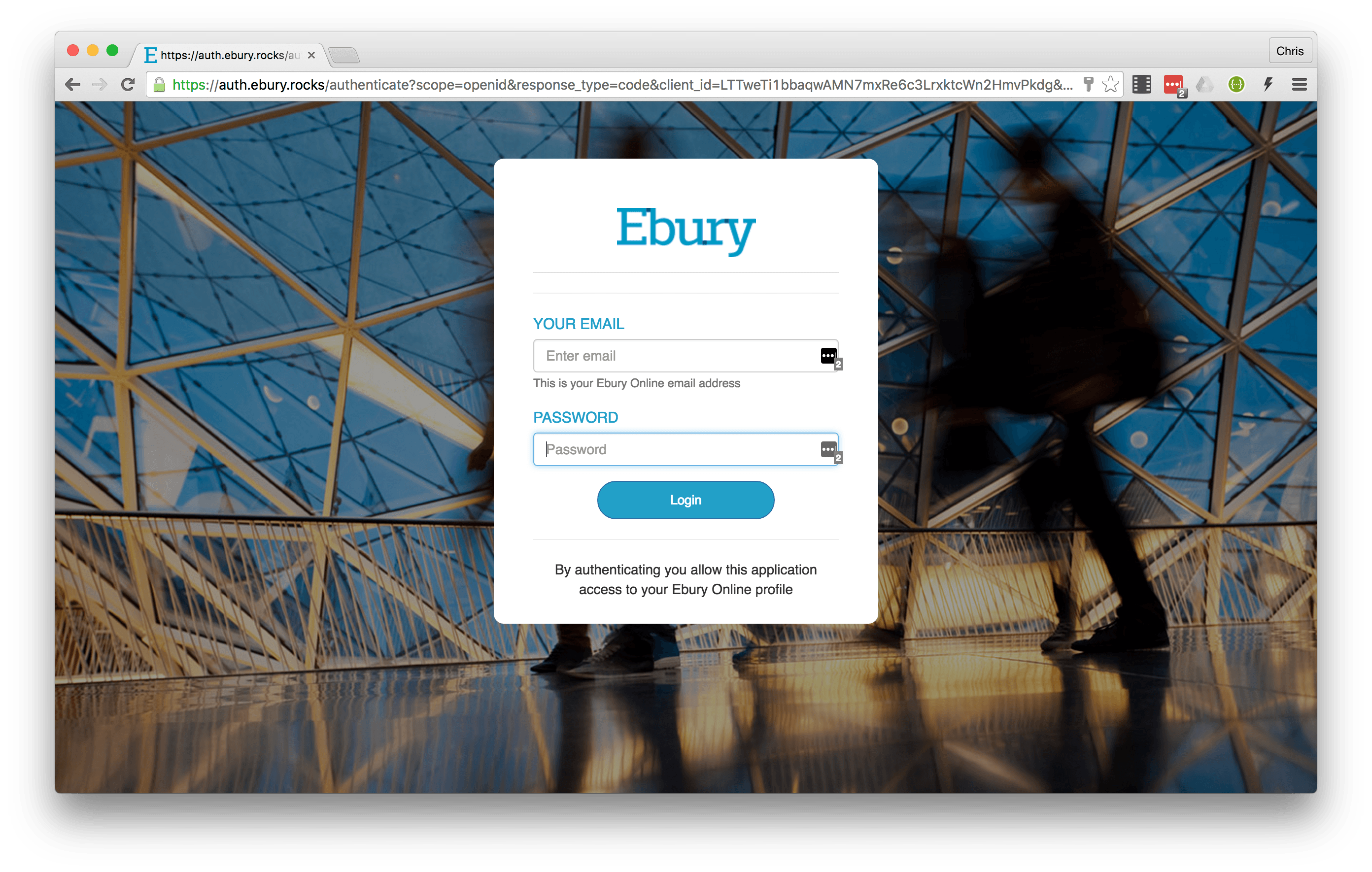

If all parameters are successfully validated the Authorization Server will present an Ebury login screen. The user will be required to enter their Ebury Online email address and password, as shown below.

When the user clicks the "Login" button after entering their credentials, an authentication process occurs behind the scenes with the following request parameters in the body.

curl -X POST \

-H "Cache-Control: no-cache" \

-H "Content-Type: application/x-www-form-urlencoded" \

https://auth.ebury.io/authenticate \

--data 'email={{EBO_LOGIN_USER}}&password={{EBO_LOGIN_PASS}}&client_id={{CLIENT_AUTH_ID}}&state={{STATE}}'

Request Parameters

| Parameter | Description |

|---|---|

emailRequired |

The user's email address for authentication |

passwordRequired |

The user's password for authentication |

client_idRequired |

Your client identifier |

stateRequired |

A random, per request value used to maintain state between request and callbacks |

Ebury redirects back to your app

The redirection process occurs after successful authentication. Ebury will redirect the user back to your registered redirect_uri with the authorization code:

HTTP/1.1 302 Found

Location: https://your.redirect.url/?code=$authorization_code&state=$state_token

<!DOCTYPE HTML PUBLIC "-//W3C//DTD HTML 3.2 Final//EN">

<title>Redirecting...</title>

<h1>Redirecting...</h1>

<p>You should be redirected automatically to target URL: <a

href="http://your.redirect.url?code=$authorization_code&state=$state_token">http://your.redirect.url?code=$authorization_code&$state_token</a>.

If not click the link.

Query Parameters

| Parameter | Description |

|---|---|

codeRequired |

The authorization code returned by the authorization endpoint |

stateRequired |

The state parameter passed from your application in the original authorization request |

No-redirect Response

Alternatively, if you prefer to handle authentication programmatically without browser redirects, you can use the No-Redirect header:

curl -X POST \

-H "Cache-Control: no-cache" \

-H "Content-Type: application/x-www-form-urlencoded" \

-H "No-Redirect: application/json" \

https://auth.ebury.io/authenticate \

--data 'email={{EBO_LOGIN_USER}}&password={{EBO_LOGIN_PASS}}&client_id={{CLIENT_AUTH_ID}}&state={{STATE}}'

POST /authenticate HTTP/1.1

Host: auth.ebury.io

Cache-Control: no-cache

Content-Type: application/x-www-form-urlencoded

No-Redirect: application/json

Request Headers

| Header | Description |

|---|---|

No-RedirectRequired |

Set to application/json to receive the authorization code in JSON format instead of being redirected |

Content-TypeRequired |

Must be application/x-www-form-urlencoded |

Cache-ControlOptional |

Set to no-cache to prevent caching of the authentication request |

Response when No-redirect header is used

{

"code": "$authorization_code$"

}

When the No-Redirect header is included in the authentication request with the value application/json, instead of redirecting the user, the response will contain only the authorization code in JSON format returning a 200 OK response. This is useful for server-to-server authentication flows where you need programmatic access to the authorization code.

Once the credentials have been successfully entered, one of two things can happen:

- If the user does not have Second Factor Authentication (2FA) enabled, the authentication process is completed (Authentication completed)

- If the user has 2FA enabled, go to Second Factor Authentication

Second Factor Authentication

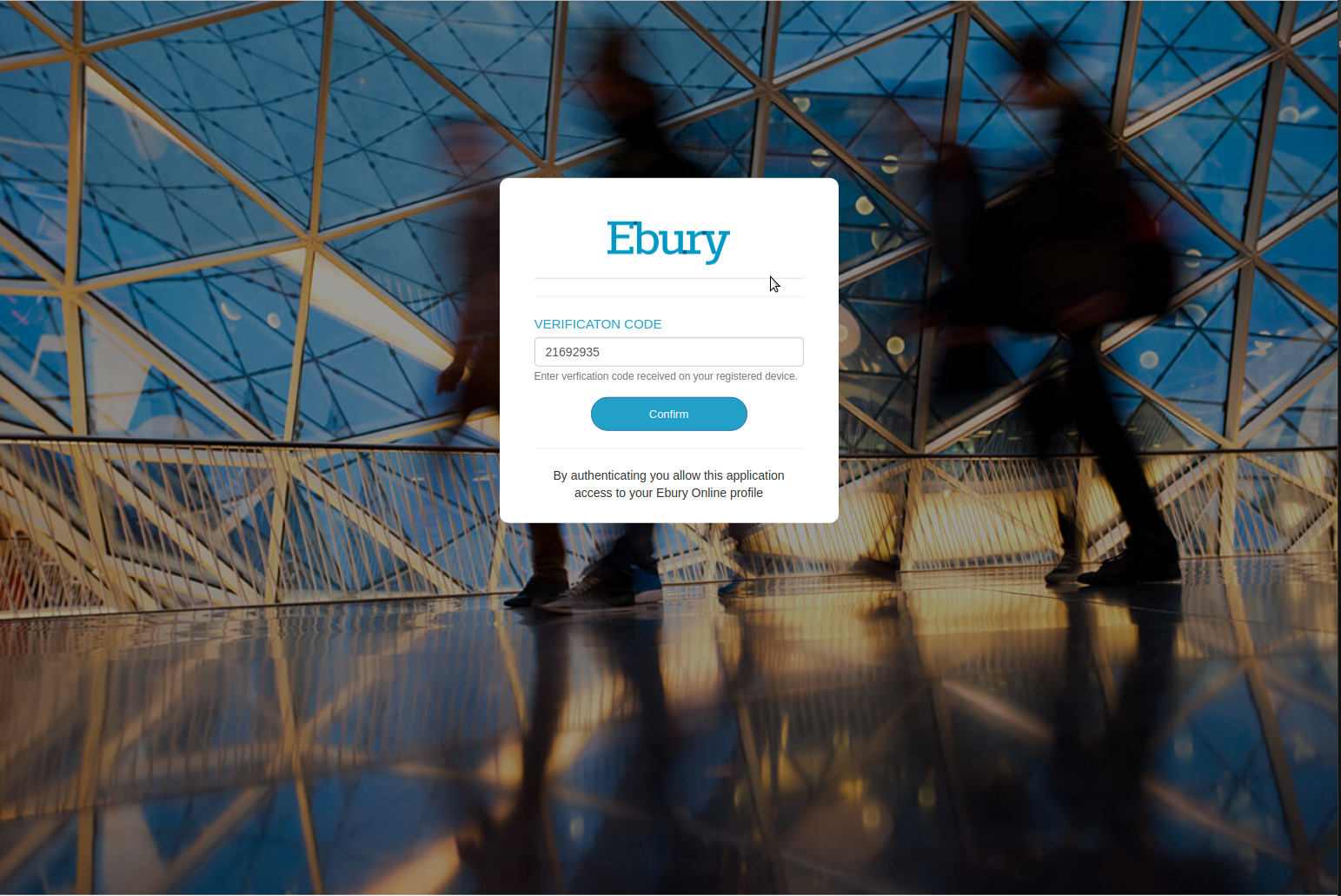

If the user has 2FA enabled, it will be redirected to the 2FA screen and will be issued a 2FA code (SMS/TOTP are supported for now). The user will be required to enter this code, as shown below:

If the verification code was entered correctly then the authentication process is completed (Authentication completed)

Query Parameters

| Parameter | Description |

|---|---|

codeRequired |

Value returned by authorization endpoint |

client_idRequired |

Your client identifier |

Authentication completed

After the authentication process is completed, the user will be redirected to the redirect_uri registered for the application. The following querystring parameters will be included:

Response Parameters

| Parameter | Description |

|---|---|

code |

A code that allows your application to call the Token Endpoint to complete the OpenID flow |

state |

Value passed from your application in the original authorization request |

Exchange the authorization code

curl -X POST \

-H "Content-Type: application/x-www-form-urlencoded" \

-H "Authorization: Basic bGV0c3ByZXRlbnQ6aXNhdGFuZW5kCg==" \

https://auth.ebury.io/token \

--data 'grant_type=authorization_code&code=$code&redirect_uri=$redirect_uri'

Response

{

"token_type": "Bearer",

"access_token": "XKtOK3hNzKpLkaom3J2MEPyKm7f7jZ",

"refresh_token": "2E9KVBXgVzQSPTvoHjJB1Eu2eBjzup",

"expires_in": 3600,

"id_token": "eyJhbGciOiAiSFMyNTYifQ==.ewogICJhdWQiOiAiWFhYWFhYWFhYWFhYWFhYWFhYWFhYWFhYWFgiLAogICJzdWIiOiAiWFhYWFhYWFhYWFgiLAogICJpc3MiOiAiaHR0cHM6Ly9hdXRoLmVidXJ5LmlvIiwKICAiaWF0IjogIjE0NjQyNjY2MzkiLAogICJjbGllbnRzIjogWwogICAgIlhYWFhYWFhYWFhYIgogIF0sCiAgImV4cCI6ICIxNDY0MzUzMDM5Igp9Cg==.bkieHxES1spJnVmDmhganElaP6LZfikKXZ8uphVQwUo"

}

The final step is for your application to exchange the authorisation code for an access token that will provide access to the API. This must happen within 10 minutes of receiving your authorisation code. The following parameters are passed to the token endpoint

Query Parameters

| Parameter | Description |

|---|---|

grant_typeRequired |

Must be set to authorization_code |

codeRequired |

Value returned by authorization endpoint |

redirect_uriRequired |

The redirect URL that is registered for your application, this must match the value we hold |

If the all parameters are correct a response will be returned containing the following:

Response Fields

| Field | Description |

|---|---|

token_type |

The Authorization header scheme to use when making requests, will be Bearer |

access_token |

An OAuth access token that can be used to call the API |

refresh_token |

An OAuth refresh token that can be used to get a new access token when when the last expires |

expires_in |

Expiry period in seconds from time token returned, currently returns 3600 (1 hour) |

id_token |

A signed, base 64 encoded JSON Web Token that provides verification of the identity that authorized the request. The token includes the client identifier, which is a required parameter on the majority of API calls. |

Decoded JSON Web Token (without signature)

{

"alg": "HS256"

}

{

"aud": "XXXXXXXXXXXXXXXXXXXXXXXXXX",

"sub": "XXXXXXXXXXX",

"iss": "https://auth.ebury.io",

"iat": "1464266639",

"clients": [{

"client_id": "XXXXXXXXXXX",

"client_name": "Example client name"

}],

"exp": "1464353039"

}

Sample code for extracting data from the JSON Web Token

var jsonData = JSON.parse(responseBody);

token = jsonData["access_token"];

postman.setEnvironmentVariable("token", token);

idtoken = parseJwt(jsonData["id_token"]);

postman.setEnvironmentVariable("contact_id", idtoken["sub"]);

clients = idtoken["clients"];

postman.setEnvironmentVariable("client_id", clients[0].client_id);

/*function to decode JSON web token*/

function parseJwt(token) {

var base64Url = token.split(".")[1];

var base64 = base64Url.replace("-", "+").replace("_", "/");

return JSON.parse(atob(base64));

}

By decoding this token we can get the value for client_id needed for future requests.

An array of client_id and client_name lists the potential clients that the contact can act on behalf of. The majority of customers will only have one client identifier, but some may have multiple client accounts and thus multiple identifiers that the contact can act on

The client_id is required in query params of requests post authentication in order to identify the client to which the request is on behalf of. Your application may have to allow a contact to select the correct client_id to use.

Refreshing access

curl -X POST \

-H "Content-Type: application/x-www-form-urlencoded" \

-H "Authorization: Basic $access_token" \

https://auth.ebury.io/token \

--data 'grant_type=refresh_token&refresh_token=$refresh_token&scope=openid'

Your access token will expire according to the value set in the Exchange the authorisation code response, but you can directly get a new access token by using your refresh token without needing to restart the authentication from the start. Our OpenID Provider conforms to the refresh token mechanism described here. The refresh token lifespan is configurable depending on the client's needs.

Request Fields

| Field | Description |

|---|---|

grant_typeRequired |

Should be refresh_token |

refresh_tokenRequired |

One of the last 10 refresh tokens, issued within the last 'n' days. Where 'n' is the refresh token lifespan agreed with the client (default value is 28 days). |

scopeRequired |

Should be openid |

If successful, the response will contain the same data as the original access token response.

Getting an access token on behalf of a client

It is possible for financial institutions to get an access token on behalf of their clients by using the contact id of the client.

This functionality is not available per default, you need to contact Ebury to enable it for each contact you need an access token for.

This endpoint is only available using mTLS.

curl -X POST \

-H "Content-Type: application/x-www-form-urlencoded" \

-H "Authorization: Basic $access_token" \

https://trusted.ebury.io/token/$contact_id \

--data 'grant_type=client_credentials'

--cert fullchain.pem \

--key privkey.pem

Path Parameters

| Parameter | Description |

|---|---|

contact_idRequired |

The contact identifier |

Request Fields

| Field | Description |

|---|---|

grant_typeRequired |

Should be client_credentials |

If successful, the response will contain the access token response.

Authenticating requests

GET /example-endpoint HTTP/1.1

Authorization: Bearer your-access-token

All requests must be authenticated with an access token.

Almost all requests will accept an optional Ebury user identifier, set in the X-Contact-Id header.

Request Headers

| Header | Description |

|---|---|

AuthorizationRequired |

Your access token, prefixed with the Bearer scheme |

x-api-key |

Your API key (Deprecated) |

X-Contact-IdOptional |

Identifier for an Ebury user (Deprecated) |

Trusted authentication

By default when a client connects to a server over HTTPS only the identity of the server is verified.

Ebury supports verifying the identity of the client as well by using a client certificate.

To use this functionality you need to connect using these URLs instead of the ones you usually use.

| Environment | Hostname |

|---|---|

Sandbox |

https://trustedsandbox.ebury.io |

Production |

https://trusted.ebury.io |

Also, note that you will use these endpoints for both authentication and API access. For example:

- To retrieve an access token in the sandbox environment you would call https://trustedsandbox.ebury.io/token instead of https://auth.ebury.io/token

- To create a payment in the sandbox environment you would call https://trustedsandbox.ebury.io/payments instead of https://api.ebury.io/payments

In order to use this functionality you need to provide Ebury with the subject distinguished name of the certificate you will be using to connect because we will match the subject DN you provide with the subject DN of the client's certificate used during the connection.

In order to check the validity of the client certificate you will be using to connect to and also to get the Subject DN of your certificate you can use the check_cert endpoint.

curl --cert fullchain.pem --key privkey.pem https://trustedsandbox.ebury.io/cert_check

package main

import (

"crypto/tls"

"io/ioutil"

"net/http"

"log"

"strings"

)

func main() {

cert, err := tls.LoadX509KeyPair("fullchain.pem",

"privkey.pem")

if err != nil {

log.Fatal(err)

}

tlsConfig := &tls.Config{

Certificates: []tls.Certificate{cert},

MinVersion: tls.VersionTLS13,

}

tlsConfig.BuildNameToCertificate()

transport := &http.Transport{TLSClientConfig: tlsConfig}

req, err := http.NewRequest("GET", "https://trustedsandbox.ebury.io/cert_check", strings.NewReader(""))

if err != nil {

log.Fatal(err)

}

client := &http.Client{Transport: transport}

resp, err := client.Do(req)

if err != nil {

log.Fatal(err)

}

contents, err := ioutil.ReadAll(resp.Body)

log.Println(string(contents))

}

#!/usr/bin/php

<?php

$ch = curl_init();

curl_setopt($ch, CURLOPT_SSLCERT, 'fullchain.pem');

curl_setopt($ch, CURLOPT_SSLKEY, 'privkey.pem');

curl_setopt($ch, CURLOPT_VERBOSE, true);

curl_setopt($ch, CURLOPT_URL,'https://trustedsandbox.ebury.io/cert_check');

$result=curl_exec($ch);

echo $result;

?>

import requests

response = requests.get('https://trustedsandbox.ebury.io/cert_check', cert=("fullchain.pem", "privkey.pem"))

print(response.text)

Response

CN=81be95eb.ngrok.io

If everything goes fine you will get a 200 response and the content of the response will be the subject DN of the certificate. You can now share the subject DN of the certificate with Ebury and the trusted connection with the regular endpoints will work without any further changes.

On the other hand, if there is a problem with the certificate or connection you might get one of these errors.

| Status Code | Error |

|---|---|

495 |

The certificate provided is invalid or the provided certificate's Subject DN does not matches the one for the client. |

496 |

There was not certificate provided. |

497 |

The connection was made using HTTP instead of HTTPS. |

You can check the next section in order to troubleshoot the issue.

Troubleshooting

In order to use this functionality the client you are connecting with must support the TLS 1.3 protocol, we don't support older versions of the protocol.

You need at least OpenSSL 1.1.1 in order to be able to use TLS 1.3, to check your openssl version you can use:

openssl version

Also, the connection must be done by using any of the following ciphers:

- TLS_AES_128_GCM_SHA256

- TLS_AES_256_GCM_SHA384

- TLS_CHACHA20_POLY1305_SHA256

You can check the ciphers supported by doing:

openssl ciphers -v | grep TLSv1.3

If you can run any of these commands and get a successfull verification you are good to go

openssl s_client -tls1_3 -ciphersuites 'TLS_AES_128_GCM_SHA256' -connect tls13.cloudflare.com:443

openssl s_client -tls1_3 -ciphersuites 'TLS_AES_256_GCM_SHA384' -connect tls13.cloudflare.com:443

openssl s_client -tls1_3 -ciphersuites 'TLS_CHACHA20_POLY1305_SHA256' -connect tls13.cloudflare.com:443

Example Workflow

If you follow the Authentication guidelines you'll have implemented the means to access the API. The following sections describe how to secure a trade, add a beneficiary and make a payment. For more detail on each of these activities please see the relevant sections.

Get a Quote

curl -X POST \

"https://api.ebury.io/quotes?quote_type=quote&client_id=$client_id" \

-H "Authorization: Bearer $access_token" \

-H "Content-Type: application/json" \

-d '{

"trade_type": "spot",

"buy_currency": "EUR",

"amount": 1500.0,

"operation": "buy",

"sell_currency": "GBP",

"value_date": "2016-09-20"

}'

Response

HTTP/1.1 201 Created

Content-Type: application/json

{

"book_trade": "/trades?client_id=TAICLI00003"e_id=9ff9aee7a6d5f5e1b797165ffe580d74",

"buy_amount": 1500.0,

"buy_currency": "EUR",

"inverse_rate": 0.910995,

"inverse_rate_symbol": "GBPEUR",

"quote_id": "9ff9aee7a6d5f5e1b797165ffe580d74",

"quoted_rate": 1.097701,

"quoted_rate_symbol": "EURGBP",

"sell_amount": 1366.49,

"sell_currency": "GBP",

"value_date": "2016-10-27"

}

To execute a trade, you need to call the Quotes endpoint and get a quote. As already discussed in Getting Started to get a quote you need the following:

- The authentication flow completed with an access token to hand;

- The correct client identifier, retrieved from the ID token generated by the Token endpoint.

The response contains a quote_id and a URL that you can use to book the trade. For more details on the Quotes API please refer to the Getting Quotes section.

Client Identifier

The client identifier is an entity Ebury uses to differentiate between different accounts in our data model. Majority of customers will only have one client identifier, but some may have multiple accounts and thus multiple identifiers.

Book a Trade

curl -X POST \

"https://api.ebury.io/trades?quote_id=$quote_id&client_id=$client_id" \

-H "Authorization: Bearer $access_token" \

-H "Content-Type: application/json" \

-d '{

"reason": "Travel costs",

"trade_type": "spot"

}'

Response

HTTP/1.1 201 Created

Content-Type: application/json

{

"bank_account": {

"account_number": "99999999",

"iban": "GB99TEST999999999999",

"swift_code": "TESTGB99",

"bank_identifier": "999999",

"bank_identifier_type": "GBP Sort Code",

"bank_name": "Name of the Bank",

"bank_address_line_1": "123 Sesame Street",

"bank_address_line_2": "Apartment 01-02",

"bank_city": "London",

"bank_post_code": "SW1W9QB"

},

"trade_id": "EBPOTR432737",

"maturiy_date": "2016-10-29T15:30:00.52Z"

}

With the quote identifier you can now book a trade to fund payment, calling the trades endpoint. Due to anti-money laundering a reason for making the trade needs to be specified; the API allows this to be a freeform value at the time of writing but future versions may introduce validation of the reason submitted.

The response contains a trade_id you can now book payments for known beneficiaries. For more details on the Trades API please refer to the Making Trades section.

Add a Beneficiary

curl -X POST \

"https://api.ebury.io/beneficiaries?client_id=$client_id" \

-H "Authorization: Bearer $access_token" \

-H "Content-Type: application/json" \

-d '{

"name": "John Doe",

"email_notification": true,

"address_line_1": "123 Sesame Street",

"post_code": "456",

"country_code": "GB",

"bank_country_code": "GB",

"bank_currency_code": "GBP",

"account_number": "99999998",

"swift_code": "TESTGBGB999",

"iban": "TESTGBGB9999999999",

}'

Response

HTTP/1.1 201 Created

Content-Type: application/json

{

"active": "True",

"address_line_1": null,

"aml_status": "Not Checked",

"bank_accounts": [

{

"account_id": 9999,

"account_number": "99999998",

"bank_address_line_1": null,

"bank_country_code": "GB",

"bank_currency_code": "GBP",

"bank_identifier": null,

"bank_name": null,

"correspondent_account": null,

"correspondent_swift_code": null,

"iban": "TESTGBGB9999999999",

"swift_code": "TESTGBGB999"

}

],

"beneficiary_id": "EBPBEN999999",

"country_code": "GB",

"created": "2016-10-25",

"email_addresses": [],

"email_notification": true,

"name": "John Doe",

"post_code": null

}

With the trade booked you can create a beneficiary who will be the recipient of part or all of the trade (of course you only need to create a beneficiary once, they are stored and can be reused later).

A beneficiary ID and account ID are returned that you can use to make a payment. For more details on the Beneficiaries API please refer to the Managing Beneficiaries section.

Make a Payment

curl -X POST \

"https://api.ebury.io/payments?client_id=$client_id" \

-H "Authorization: Bearer $access_token" \

-H "Content-Type: application/json" \

-d '{

"trade_id": "EBPOTR999999",

"async": false,

"payments":[

{

"beneficiary_id": "EBPBEN999999",

"account_id": "99999",

"amount": 10.50,

"payment_date": "2016-10-30",

"reference": "2016-10-29",

"email_beneficiary": true

}

]

}'

Response

HTTP/1.1 201 Created

Content-Type: application/json

[

{

"payment_id": "PI999999",

"payment_instruction": "/documents?type=pi&id=PI999999&client_id=TAICLI00003",

"payment_receipt": "Not available",

"status": "Validating beneficiary information"

}

]

Everything is now in place to book on or more payments, using the trade_id and beneficiary and account IDs returned from the create beneficiary step.

A payment_id will be returned together with links to download the payment instruction and receipt documents when available; if you are set-up to to pay immediately the payment will be made when:

- The beneficiary is validated;

- Funds are available;

- The payment date is reached.

If the payment requires authorisation an additional PATCH method will be required; refer to the notes in the Making Payments section for details.

Clients

Get Clients

Retrieve the list of clients which a contact can access, including their brands and status.

Request Headers

GET /clients HTTP/1.1

Authorization: string

Query Parameters

| Name | Field Type | Location | Max Length | Accepted Values | Mandatory | Additional Info |

|---|---|---|---|---|---|---|

page |

integer |

query |

>=1 |

N |

The desired page number for pagination. Default value is 1 |

|

page_size |

integer |

query |

>=1 |

N |

The number of items per page for pagination. Default value is 50 |

Response

[

{

"address_line_1": "string",

"address_line_2": "string",

"brand_name": "string",

"city": "string",

"client_id": "string",

"client_name": "string",

"country_name": "string",

"post_code": "string",

"state_province": "string",

"status": "string"

}

]

A successful request will return a 200 OK response with a response body consisting of an array of objects with the following fields:

| Name | Field Type | Location | Max Length | Additional Info |

|---|---|---|---|---|

content-type |

application/json |

header |

||

x-total-count |

integer |

header |

Total number of entries returned. | |

content-length |

string |

header |

||

address_line_1 |

string |

body |

The first address line of the client. | |

address_line_2 |

string |

body |

The second address line of the client. | |

brand_name |

string |

body |

The brand of the client (e.g. Ebury). | |

city |

string |

body |

The city of the client. | |

client_id |

string |

body |

The client identification number (e.g. EBPCLIXXXX). | |

client_name |

string |

body |

The name of the client. | |

country_name |

string |

body |

The country of the client address. | |

post_code |

string |

body |

The post code of the client address. | |

state_province |

string |

body |

The state/province of the client address. | |

status |

string |

body |

Status of the client. It can be: “Active”, “Inactive”, “Closed” or “Blocked”. |

Getting Quotes

Get an estimate or firm quote:

- An estimate is as it's described: the current rates on offer within the Ebury platform with no firm quote;

- A firm quote returns a reference (a

quote_id) that can be used to book a trade.

Get an estimate or firm quote

POST /quotes?client_id=$client_id"e_type=$quote_type HTTP/1.1

Authorization: string

Content-Type: application/json

{

"trade_type": "string",

"sell_currency": "string",

"buy_currency": "string",

"amount": "number",

"operation": "string",

"value_date": "string"

}

Obtain either an estimate or firm quote; estimates are for reference only, while a firm quote can be used to book a trade.

Request Headers

| Header | Description |

|---|---|

Content-TypeRequired |

application/json |

Query Parameters

| Parameter | Description |

|---|---|

quote_typeRequired |

The type of quote you are requesting. Acceptable values:

|

client_idRequired |

The client identifier you are requesting this quote for |

Request Body

| Field | Description |

|---|---|

trade_typeRequired |

The type of trade you require a quote for. Acceptable values:

|

sell_currencyRequired |

Sell currency |

buy_currencyRequired |

Buy currency |

amountRequired |

Amount in double format |

operationRequired |

The operation you want to perform. Acceptable values:

|

value_date |

The date you want the quote. If the value date is not provided or is invalid then the quote will be returned for next available value date. YYYY-MM-DD format. |

Estimate Quote Response

HTTP/1.1 200 OK

Content-Type: application/json

{

"estimated_rate": "number",

"estimated_rate_symbol": "string",

"inverse_rate": "number",

"inverse_rate_symbol": "string",

"fee_amount": "number",

"fee_currency": "string",

"value_date": "string",

"warning": "string"

}

Quote requests with a quote_type of estimate will return a 200 OK response with the following response body.

Fields

| Field | Description |

|---|---|

estimated_rateAlways |

The estimated rate |

estimated_rate_symbolAlways |

The symbol of estimated rate |

inverse_rateAlways |

Inverse rate |

inverse_rate_symbolAlways |

The symbol of inverse rate |

fee_amountAlways |

Fee amount |

fee_currencyAlways |

Fee currency |

value_dateAlways |

Date on which quote is requested. YYYY-MM-DD format. |

warning |

A warning is only returned if the requested value date was not valid and the next available date has been returned. |

Firm Quote Response

HTTP/1.1 201 Created

Content-Type: application/json

{

"quote_id": "string",

"sell_currency": "string",

"sell_amount": "number",

"buy_currency": "string",

"buy_amount": "number",

"quoted_rate": "number",

"quoted_rate_symbol": "string",

"inverse_rate": "number",

"inverse_rate_symbol": "string",

"value_date": "string",

"book_trade": "string",

"warning": "string"

}

Quote requests with a quote_type of quote will return a 201 Created response with the following response body.

Fields

| Field | Description |

|---|---|

quote_idAlways |

Quote identifier. Used to create book a trade at the Trades endpoint |

sell_currencyAlways |

Sell currency |

sell_amountAlways |

Sell amount |

buy_currencyAlways |

Buy currency |

buy_amountAlways |

Buy amount |

quoted_rateAlways |

The rate quoted |

quoted_rate_symbolAlways |

The symbol of rate quoted |

inverse_rateAlways |

The inverse rate |

inverse_rate_symbolAlways |

The symbol of inverse rate |

value_dateAlways |

Date on which trade active. YYYY-MM-DD format. |

book_trade |

Call this endpoint to book the trade (refer to Trades documentation for required payload) |

warning |

A warning is only returned if the requested value date was not valid and the next available date has been returned. |

Get FX markets availability

curl --location --request GET '/quotes/fx-availability?client_id=XXXXXX' \

--header 'Authorization: $token' \

--header 'Content-Type: application/json'

import requests

import json

url = "/quotes/fx-availability?client_id=XXXXXX"

payload={}

headers = {

'Authorization': token,

'Content-Type': 'application/json'

}

response = requests.request("GET", url, headers=headers, data=payload)

print(response.text)

package main

import (

"fmt"

"net/http"

"io/ioutil"

)

func main() {

url := "/quotes/fx-availability?client_id=XXXXXX"

method := "GET"

client := &http.Client {

}

req, err := http.NewRequest(method, url, nil)

if err != nil {

fmt.Println(err)

return

}

req.Header.Add("Authorization", token)

req.Header.Add("Content-Type", "application/json")

res, err := client.Do(req)

if err != nil {

fmt.Println(err)

return

}

defer res.Body.Close()

body, err := ioutil.ReadAll(res.Body)

if err != nil {

fmt.Println(err)

return

}

fmt.Println(string(body))

}

<?php

#!/usr/bin/php

$curl = curl_init();

curl_setopt_array($curl, array(

CURLOPT_URL => '/quotes/fx-availability?client_id=XXXXXX',

CURLOPT_RETURNTRANSFER => true,

CURLOPT_ENCODING => '',

CURLOPT_MAXREDIRS => 10,

CURLOPT_TIMEOUT => 0,

CURLOPT_FOLLOWLOCATION => true,

CURLOPT_HTTP_VERSION => CURL_HTTP_VERSION_1_1,

CURLOPT_CUSTOMREQUEST => 'GET',

CURLOPT_HTTPHEADER => array(

'Authorization: $token',

'Content-Type: application/json'

),

));

$response = curl_exec($curl);

curl_close($curl);

echo $response;

The endpoint can be used to understand if foreign exchange can be initiated at that time or not. It is useful in instances which want to proactively manage whether or not to allow the user to attempt FX rather than throwing an error after the FX initiation request.

Query Parameters

| Parameter | Description |

|---|---|

client_idRequired |

The ID of the client |

Response

Response

HTTP/1.1 200 OK

Content-Type: application/json

{

"fx_available": "boolean",

}

A successful request will return a 200 OK response with the following response body.

Fields

| Name | Description |

|---|---|

fx_availableALWAYS |

True if the FX market is available for creating quote and trades. False if otherwise. |

Making Trades

Create a Trade

POST /trades?client_id=$client_id"e_id=$quote_id HTTP/1.1

Authorization: string

Content-Type: application/json

{

"reference": "string",

"reason": "string",

"external_reference_id": "string",

"convert": "boolean"

}

Initiate a new trade.

Request Headers

| Header | Description |

|---|---|

Content-TypeRequired |

application/json |

Query Parameters

| Parameter | Description |

|---|---|

quote_idRequired |

The identifier of the quote, obtained from making a firm quote |

client_idRequired |

The ID of the client |

Request Body

Fields

| Name | Description |

|---|---|

reasonRequired |

Reason for trade. See ReasonForTradeValues for acceptable values. |

reference |

Reference for the trade. |

external_reference_id |

API external reference id for the trade. |

convert |

Intention behind the trade. When set to true, trade will be executed and funds will be transferred between two Ebury wallets. When false, trade will be executed only when it is linked to at least one payment. By default, the field is set to false. |

Response

HTTP/1.1 201 Created

Content-Type: application/json

{

"trade_id": "string",

"bank_account": {

"account_number": "string",

"iban": "string",

"swift_code": "string",

"bank_identifier": "string",

"bank_identifier_type": "string",

"bank_name": "string",

"bank_address_line_1": "string",

"bank_address_line_2": "string",

"bank_city": "string",

"bank_post_code": "string"

},

"maturity_date": "string",

"initial_margin_amount": "number",

"initial_margin_due_date": "string"

}

A successfully created trade will return a 201 Created response with the following response body.

Fields

| Name | Description |

|---|---|

trade_idRequired |

Trade identifier |

bank_accountRequired |

An existing bank account |

maturity_dateRequired |

Limit date and time (UTC) in which funds must be received by Ebury |

initial_margin_amount |

Only for forwards. Trade's deposit amount |

initial_margin_due_date |

Only for forwards. Date on or before which deposit must be received by Ebury. Date and time are in UTC. |

Get all trades

GET /trades?client_id=$client_id HTTP/1.1

Authorization: string

Get all the trades for a given client ID.

Query Parameters

| Parameter | Description |

|---|---|

client_idRequired |

The ID of the client |

trade_type |

Filter the response to include only trades with a matching type, which are specified by an array[string]Acceptable values:

|

parent_trade_id |

Parent identifier for drawdown trades |

page |

The desired page number for pagination. Default value is 1. |

page_size |

The number of items per page for pagination. Default value is 50. |

mass_payment_id |

Filter by related mass payment's uuid. |

mass_payment_external_reference_id |

Filter by related mass payment's external reference. |

buy_currency |

Filter by buy currency. |

status |

Filter trade by statuses. Separated by comma Acceptable values:

|

external_reference_id |

Filter by API external reference id. |

from_maturity_date |

Only return trades with trade maturity date on or after the from_maturity_date. YYYY-MM-DD format. |

to_maturity_date |

Only return trades with trade maturity date on or before the to_maturity_date. YYYY-MM-DD format. |

from_order_date |

Only return trades with trade order date on or after the from_order_date. YYYY-MM-DD format. |

to_order_date |

Only return trades with trade order date on or before the to_order_date. YYYY-MM-DD format. |

Response

HTTP/1.1 200 OK

Content-Type: application/json

x-total-count: 1

[

{

"trade_id": "string",

"trade_type": "string",

"status": "string",

"buy_currency": "string",

"buy_amount": "number",

"buy_balance_for_drawdown": "number",

"sell_currency": "string",

"sell_amount": "number",

"sell_balance_for_drawdown": "number",

"initial_margin": "number",

"margin_call": "number",

"rate": "number",

"rate_symbol": "string",

"order_date": "string",

"maturity_date": "string",

"fee_currency": "string",

"fee_amount": "number",

"synthetic": "boolean",

"trade_receipt": "string",

"reference": "string",

"parent_trade_id": "string"

}

]

A successful request will return a 200 OK response with the response body containing a list of trade objects presented with the BookedTrade model. In addition the total number of entries is available in the header field x-total-count.

Get a trade

GET /trades/$trade_id?client_id=$client_id HTTP/1.1

Authorization: string

Get a trade with a specific trade_id.

Path Parameters

| Parameter | Description |

|---|---|

trade_idRequired |

Trade identifier |

Query Parameters

| Parameter | Description |

|---|---|

client_idRequired |

The ID of the client |

Response

HTTP/1.1 200 OK

Content-Type: application/json

{

"trade_id": "string",

"trade_type": "string",

"status": "string",

"buy_currency": "string",

"buy_amount": "number",

"buy_balance_for_drawdown": "number",

"sell_currency": "string",

"sell_amount": "number",

"sell_balance_for_drawdown": "number",

"initial_margin": "number",

"margin_call": "number",

"rate": "number",

"rate_symbol": "string",

"order_date": "string",

"maturity_date": "string",

"fee_currency": "string",

"fee_amount": "number",

"synthetic": "boolean",

"parent_trade_id": "string",

"trade_receipt": "string",

"reference": "string"

}

A successful request will return a 200 OK response with the requested trade object in response body presented with the BookedTrade model.

Trade Models

These models are returned by the get all trades and get a trade endpoints.

BookedTrade

{

"trade_id": "string",

"trade_type": "string",

"status": "string",

"buy_currency": "string",

"buy_amount": "number",

"buy_balance_for_drawdown": "number",

"sell_currency": "string",

"sell_amount": "number",

"sell_balance_for_drawdown": "number",

"initial_margin": "number",

"margin_call": "number",

"rate": "number",

"rate_symbol": "string",

"order_date": "string",

"maturity_date": "string",

"fee_currency": "string",

"fee_amount": "number",

"synthetic": "boolean",

"parent_trade_id": "string",

"trade_receipt": "string",

"reference": "string",

"convert": "boolean"

}

This model is a representation of a booked trade.

Fields

| Name | Description |

|---|---|

trade_idAlways |

Trade identifier |

trade_typeAlways |

Trade type |

statusAlways |

Status of the trade |

buy_currencyAlways |

Buy currency code |

buy_amountAlways |

Buy amount |

buy_balance_for_drawdownAlways |

Remaining buy amount in the Forward after deducting the drawdown amounts |

sell_currencyAlways |

Sell currency code |

sell_amountAlways |

Sell amount |

sell_balance_for_drawdownAlways |

Remaining sell amount in the Forward after deducting the drawdown amounts |

initial_marginAlways |

The remaining initial margin after deducting the amount used in the drawdowns. |

margin_callAlways |

The summation of the remaining margin calls after deducting the amount used in the drawdowns. |

rateAlways |

Booked rate |

rate_symbolAlways |

The symbol of booked rate |

order_dateAlways |

Order date |

maturity_dateAlways |

Limit date and time (UTC) in which funds must be received by Ebury |

fee_currencyAlways |

Fee currency |

fee_amountAlways |

Fee amount |

parent_trade_idAlways |

Parent trade ID (not null for drawdown trades) |

syntheticAlways |

Identifies as a synthetic future contracts |

trade_receipt |

The URL to get the trade receipt |

reference |

Additional trade reference e.g., invoice number |

convert |

Intention behind the trade (either to move funds internally between Ebury wallets or to link payments to trades) |

TradeStatus

This is an enumeration of the status of a trade, and can be found in the BookedTrade model.

Values

| Value | Description |

|---|---|

Created |

Trade has been created |

Funds In Partially |

The trade has been partially funded |

Funds in Full |

The trade has been fully funded |

Funds Out Partially Allocated |

The proceeds of the trade have been only partially allocated to payments out |

Funds Out Full Allocated |

The proceeds of the trade have been fully allocated to payments out |

Closed |

The proceeds of the trade have been fully paid out and the trade is closed |

Cancelled |

The trade has been cancelled |

ReasonForTradeValues

This is list of acceptable values for the reason field when creating a trade.

Values

| Value | Description | MiFID |

|---|---|---|

payment_for_goods |

Payment for identifiable goods | No |

payment_for_services |

Payment for identifiable services | No |

repatriation_of_goods |

Repatriation of sale of identifiable goods | No |

repatriation_of_services |

Repatriation of sale of identifiable services | No |

intercompany_funding_operational_purposes |

Intercompany funding for operational purposes | No |

salary_payroll |

Salary/Payroll | No |

tax_related |

Tax related | No |

direct_investment |

Direct investment | No |

property_purchase_sale |

Payments for property purchase or sale | No |

payment_living_costs |

Payment for living costs | No |

repayment_of_loan |

Repayment of a loan | Yes |

balance_hedging |

Balance sheet hedging | Yes |

repatriation_from_investment |

Repatriation of revenues from investments | Yes |

other_not_related_to_goods_or_services |

Other not related to goods or services | Yes |

Deprecated Values

| Value | Description |

|---|---|

charitable_aid |

Charitable Aid |

capital_investment |

Direct capital investment in an enterprise |

property_purchase |

Property purchase |

mortage_repayment |

Mortage repayment |

property_rental_or_maintenance |

Property rental/maintenance |

travel_costs |

Travel costs |

living_costs |

Living costs |

portfolio_netting |

Portfolio netting |

not_related_to_goods_or_services |

Other not related to identifiable goods or services (only Spot type) |

other |

Other |

Drawdowns

Create a Drawdown

POST /drawdowns?client_id=$client_id&trade_id=$trade_id HTTP/1.1

Authorization: string

Content-Type: application/json

{

"amount": "number",

"operation": "string",

"use_margin": "boolean",

"convert": "boolean",

"reason_for_trade": "string",

"value_date": "string",

"auto_confirm_value_date": "boolean",

"external_reference_id": "string"

}

Create a drawdown from an existing window forward trade.

Request Headers

| Header | Description |

|---|---|

Content-TypeRequired |

application/json |

Query Parameters

| Parameter | Description |

|---|---|

client_idRequired |

The ID of the client |

trade_idRequired |

The ID of the window forward trade to drawdown from |

Request Body

Fields

| Name | Description |

|---|---|

amountRequired |

The amount to draw down. |

operationRequired |

The operation to perform on the amount. Acceptable values:

|

value_dateRequired |

Up to T+2 value date for the drawdown in YYYY-MM-DD format. |

reason_for_tradeRequired |

Reason for trade. See ReasonForTradeValues for acceptable values. |

use_marginRequired |

Whether to use any available margin from the forward trade to fund the drawdown. Defaults to false. |

convertRequired |

Intention behind the drawdown. When set to true, drawdown will be executed and funds will be transferred between two Ebury wallets. When false, drawdown will be executed only when it is linked to at least one payment. Defaults to false. |

auto_confirm_value_date |

When set to true, the next available value date will be used if the requested date is invalid. When false, the request will fail if the value date is not valid. Defaults to false. |

external_reference_id |

API external reference id for the drawdown. Maximum 128 characters. Alphanumeric, hyphens, and underscores only. |

Response

HTTP/1.1 201 Created

Content-Type: application/json

{

"trade_id": "string",

"amount_to_transfer": "number",

"buy_amount": "number",

"sell_amount": "number",

"rate": "string",

"reason_for_trade": "string",

"external_reference_id": "string",

"convert": "boolean",

"value_date": "string",

"deposit_not_used": "string",

"bank_account": {

"account_number": "string",

"account_subtype": "string",

"account_type": "string",

"active": "boolean",

"bank_address": {

"address_line1": "string",

"address_line2": "string",

"city": "string",

"postal_code": "string"

},

"bank_country_iso3": "string",

"bank_identifier": "string",

"bank_identifier_type": "string",

"bank_name": "string",

"holder": "string",

"holder_address": "string",

"iban": "string",

"swift": "string",

"unique_id": "string"

},

"fee": {

"payment": {

"amount": "number",

"currency": "string"

},

"trade": {

"amount": "number",

"currency": "string"

}

},

"fee_bank_account": {

"account_number": "string",

"account_subtype": "string",

"account_type": "string",

"active": "boolean",

"bank_address": {

"address_line1": "string",

"address_line2": "string",

"city": "string",

"postal_code": "string"

},

"bank_country_iso3": "string",

"bank_identifier": "string",

"bank_identifier_type": "string",

"bank_name": "string",

"holder": "string",

"holder_address": "string",

"iban": "string",

"swift": "string",

"unique_id": "string"

}

}

A successfully created drawdown will return a 201 Created response with the following response body.

Fields

| Name | Description |

|---|---|

trade_id |

Drawdown trade identifier |

amount_to_transfer |

The amount to be transferred |

buy_amount |

The amount in the buy currency |

sell_amount |

The amount in the sell currency |

rate |

The exchange rate applied |

reason_for_trade |

The reason for trade specified in the request |

external_reference_id |

Your external reference ID if provided |

convert |

Whether funds will be converted |

value_date |

The value date for the drawdown (ISO 8601 format with timezone) |

deposit_not_used |

Amount of deposit not used from the forward trade |

bank_account |

Bank account details for funding the drawdown |

fee |

Fee details for the drawdown, including payment and trade fees |

fee_bank_account |

Bank account details for the fee payment (can be null) |

Getting Metadata

The Metadata endpoints provide the following information:

- A full list of supported currencies;

- A digest of the requirements for provisioning beneficiaries

Get beneficiary metadata

GET /metadata/beneficiary HTTP/1.1

Authorization: string

Describes the fields required to provision a valid beneficiary for a given country/currency combination:

- All supported countries are described by this API;

- For each supported country, any currency that has specific requirements is defined in the currencies list. If there are no specific requirements the value

defaultshould be used. - The response of this endpoint is in line with the SWIFT ISO20022 standards. Please note, the mandatory fields and business rules around beneficiary address defined via this endpoint, does not apply to Ebury Mass Payments customers. Should you have any doubts, please reach out to us.

Response

HTTP/1.1 200 OK

Content-Type: application/json

[

{

"country": "string",

"currencies": [

{

"currency": "string",

"mandatory": [

[

"string"

]

],

"optional_data": [

"string"

]

}

],

"reason_required": "boolean"

}

]

A successful request will return a 200 OK response with a response body consisting of a list of the following objects.

Fields

| Name | Description |

|---|---|

country |

Two-letter country identifier |

currencies |

List of currency objects; will contain at least one default object |

currencies.currency |

Currency symbol |

currencies.mandatory |

List of mandatory field combinations; combinations are presented as lists |

currencies.optional |

List of optional fields |

reason_required |

boolean flag |

Get currency metadata

GET /metadata/currency HTTP/1.1

Authorization: string

Describe a currency

Query Parameters

| Parameter | Description |

|---|---|

data_only |

Exclude reason_required flag from response; Defaults to false |

Response

HTTP/1.1 200 OK

Content-Type: application/json

[

{

"currency": "string",

"buy": {

"cutoff_days": "integer",

"cutoff_time": "string"

},

"reason_required": "boolean",

"sell": {

"cutoff_days": "integer",

"cutoff_time": "string"

},

"invalid_value_dates": {

"YYYY-MM-DD": "string"

}

}

]

A successful request will return a 200 OK response with a response body consisting of a list of the following objects.

Fields

| Name | Description |

|---|---|

buy |

Information of this currency if it is used as "buy" currency |

buy.cutoff_days |

Cutoff days of the currency |

buy.cutoff_time |

Cutoff time for the currency in GMT/UTC |

currency |

Currency symbol |

invalid_value_dates |

Invalid trading dates and their reasons |

invalid_value_dates.YYYY-MM-DD |

Invalid trading date; the value of this key is the reason the date is invalid |

reason_required |

Show if reason required for this currency is mandatory |

sell |

Information of this currency if it is used as "sell" currency |

sell.cutoff_days |

Cutoff days of the currency |

sell.cutoff_time |

Cutoff time for the currency in GMT/UTC |

Managing Beneficiaries

Create a new beneficiary

POST /beneficiaries?client_id=$client_id HTTP/1.1

Authorization: string

Content-Type: application/json

{

"name": "string",

"email_addresses": [

"string"

],

"email_notification": "boolean",

"address_line_1": "string",

"street_name": "string",

"building_number": "string",

"floor": "string",

"apartment_office_number": "string",

"city": "string",

"state_region": "string",

"post_code": "string",

"country_code": "string",

"account_number": "string",

"bank_address_line_1": "string",

"bank_country_code": "string",

"bank_currency_code": "string",

"bank_identifier": "string",

"bank_name": "string",

"correspondent_account": "string",

"correspondent_swift_code": "string",

"iban": "string",

"inn": "string",

"kbk": "string",

"kio": "string",

"kpp": "string",

"purpose_of_payment": "string",

"reason_for_trade": "string",

"reference_information": "string",

"beneficiary_reference": "string",

"russian_central_bank_account": "string",

"swift_code": "string",

"vo": "string"

}

Create a new client beneficiary. Beneficiary will require verification before payments can be made

Request Headers

| Header | Description |

|---|---|

Content-TypeRequired |

application/json |

Query Parameters

| Parameter | Description |

|---|---|

client_idRequired |

The ID of the client |

Request Body

Fields

| Name | Description |

|---|---|

nameRequired |

The name of the beneficiary |

email_addresses |

List of email addresses |

email_notificationRequired |

Whether the beneficiary should receive email notification of payments |

address_line_1* |

The first address line of the beneficiary (deprecated)* |

street_name* |

The street name of the beneficiary |

building_number* |

The building number of the beneficiary |

floor* |

The floor of the beneficiary |

apartment_office_number* |

The apartment/office number of the beneficiary |

city*Required |

The city of the beneficiary |

state_region* |

The state/region of the beneficiary |

post_code |

The postcode of the beneficiary |

country_codeRequired |

The ISO 3166-1 alpha-2 code of the beneficiary's country |

account_number |

The account number of the bank account |

bank_address_line_1 |

The first address line of the bank |

bank_country_codeRequired |

The ISO 3166-1 alpha-2 code of the bank's country |

bank_currency_codeRequired |

The ISO 4217 code of the bank account's currency |

bank_identifier |

The identifier of the bank |

bank_name |

Name of the bank account holder |

correspondent_account |

The account for the correspondent account of the bank |

correspondent_swift_code |

The SWIFT code for the correspondent account of the bank |

iban |

The IBAN of the bank account |

inn |

Unique Taxpayer Personal Identification Number for legal entities registered in Russia. |

kbk |

The KBK of the bank account |

kio |

Tax ID for foreign legal entities in Russia. |

kpp |

The KPP of the bank account |

purpose_of_payment |

The purpose of payment is mandatory when the beneficiary account has specific currency types. See the section PurposeOfPayment for the currencies and their acceptable values. |

reason_for_trade |

The reason for trade of the bank account |

reference_information |

The reference information which will be used as the default payment reference during payment initiation. |

beneficiary_reference |

Unique external reference ID submitted by the client for the beneficiary. |

russian_central_bank_account |

20-digit code for Russian banks. |

swift_code |

The SWIFT code of the bank account |

vo |

Code of currency transaction established by the Central Bank of Russia to describe the purpose of the payment. |

* This field and the related rule becomes operational from October 2024. Further communication will follow over emails. Please note, it does not apply to Ebury Mass Payments customers in Production.

Response

HTTP/1.1 201 Created

Content-Type: application/json

{

"name": "string",

"email_addresses": [

"string"

],

"email_notification": "boolean",

"address_line_1": "string",

"street_name": "string",

"building_number": "string",

"floor": "string",

"apartment_office_number": "string",

"city": "string",

"state_region": "string",

"post_code": "string",

"country_code": "string",

"bank_accounts": [

{

"account_number": "string",

"bank_address_line_1": "string",

"bank_country_code": "string",

"bank_currency_code": "string",

"bank_identifier": "string",

"bank_identifier_type": "string",

"bank_name": "string",

"correspondent_account": "string",

"correspondent_swift_code": "string",

"iban": "string",

"inn": "string",

"kbk": "string",

"kio": "string",

"kpp": "string",

"reason_for_trade": "string",

"reference_information": "string",

"russian_central_bank_account": "string",

"swift_code": "string",

"vo": "string",

"account_id": "integer"

}

],

"beneficiary_id": "string",

"created": "string",

"aml_status": "string",

"active": "string",

"beneficiary_reference": "string",

}

A successful request will return a 201 Created response with the response body containing a Beneficiary object.

Get beneficiaries

GET /beneficiaries?client_id=$client_id HTTP/1.1

Authorization: string

Get all beneficiaries for a given client

Query Parameters

| Parameter | Description |

|---|---|

client_idRequired |

The ID of the client |

page |

The desired page number for pagination. Default value is 1. |

page_size |

The number of items per page for pagination. Default value is 50. |

iban |

The IBAN of the beneficiary. |

account_number |

The account number of the beneficiary. |

bank_currency_code |

The currency of the beneficiary's account. |

bank_identifier |

The bank identifier of the beneficiary's account. |

beneficiary_reference |

Unique external reference ID submitted by the client for the beneficiary. |

Response

HTTP/1.1 200 OK

Content-Type: application/json

x-total-count: 1

[

{

"name": "string",

"email_addresses": [

"string"

],

"email_notification": "boolean",

"address_line_1": "string",

"street_name": "string",

"building_number": "string",

"floor": "string",

"apartment_office_number": "string",

"city": "string",

"state_region": "string",

"post_code": "string",

"country_code": "string",

"bank_accounts": [

{

"account_number": "string",

"bank_address_line_1": "string",

"bank_country_code": "string",

"bank_currency_code": "string",

"bank_identifier": "string",

"bank_identifier_type": "string",

"bank_name": "string",

"correspondent_account": "string",

"correspondent_swift_code": "string",

"iban": "string",

"inn": "string",

"kbk": "string",

"kio": "string",

"kpp": "string",

"purpose_of_payment": "string",

"reason_for_trade": "string",

"reference_information": "string",

"russian_central_bank_account": "string",

"swift_code": "string",

"vo": "string",

"account_id": "integer"

}

],

"beneficiary_id": "string",

"created": "string",

"aml_status": "string",

"active": "string",

"beneficiary_reference": "string",

}

]

A successful request will return a 200 OK response with the response body containing a list of Beneficiary objects. In addition the total number of entries is available in the header field x-total-count.

Get a single beneficiary

GET /beneficiaries/$beneficiary_id?client_id=$client_id HTTP/1.1

Authorization: string

Get a single beneficiary by beneficiary ID

Path Parameters

| Parameter | Description |

|---|---|

beneficiary_idRequired |

The ID of the beneficiary |

Query Parameters

| Parameter | Description |

|---|---|

client_idRequired |

The ID of the client |

Response

HTTP/1.1 200 OK

Content-Type: application/json

[

{

"name": "string",

"email_addresses": [

"string"

],

"email_notification": "boolean",

"address_line_1": "string",

"street_name": "string",

"building_number": "string",

"floor": "string",

"apartment_office_number": "string",

"city": "string",

"state_region": "string",

"post_code": "string",

"country_code": "string",

"bank_accounts": [

{

"account_number": "string",

"bank_address_line_1": "string",

"bank_country_code": "string",

"bank_currency_code": "string",

"bank_identifier": "string",

"bank_identifier_type": "string",

"bank_name": "string",

"correspondent_account": "string",

"correspondent_swift_code": "string",

"iban": "string",

"inn": "string",

"kbk": "string",

"kio": "string",

"kpp": "string",

"purpose_of_payment": "string",

"reason_for_trade": "string",

"reference_information": "string",

"russian_central_bank_account": "string",

"swift_code": "string",

"vo": "string",

"account_id": "integer"

}

],

"beneficiary_id": "string",

"created": "string",

"aml_status": "string",

"active": "string"

"beneficiary_reference": "string",

}

]

A successful request will return a 200 OK response with the response body containing a Beneficiary object.

Update a beneficiary

PATCH /beneficiaries/$beneficiary_id?client_id=$client_id HTTP/1.1

Authorization: string

Content-Type: application/json

{

"name": "string",

"email_addresses": [

"string"

],

"email_notification": "boolean",

"address_line_1": "string",

"street_name": "string",

"building_number": "string",

"floor": "string",

"apartment_office_number": "string",

"city": "string",

"state_region": "string",

"post_code": "string",

"country_code": "string",

"bank_accounts": [

{

"account_number": "string",

"bank_address_line_1": "string",

"bank_country_code": "string",

"bank_currency_code": "string",

"bank_identifier": "string",

"bank_identifier_type": "string",

"bank_name": "string",